As a marine cooperation forum, the Finnish Maritime Association draws attention to the significance of shipping and other maritime activities for Finland, and aims to promote interest, awareness and appreciation of the maritime sectors. Since 1986, the Association has awarded nine Maritime Achievement Honorary Awards. It is also the major shareholder in the publishing company of this Navigator magazine. The Association organizes annual Maritime Strategy Forums and lunch meetings with high-quality presentations and discussion on topical issues. It arranges excursions and visits to places and organizations of maritime interest a few times a year.

Two major maritime cluster studies were conducted in Finland in the years 2003 and 2008. During the market collapse in 2013 Finland was lacking proper economic indicators on the maritime businesses. On the Maritime Association’s initiative efforts for sufficient funding were made for a new, comprehensive cluster study which also included CEO interviews and new type of value chain sector analysis. One of the conclusions from the CEO interviews in the 2015 cluster study was the low level of interaction between the various segments in the cluster. In addition to the conclusion of the economic importance of the maritime cluster for the nation, the Government of Finland launched a number of special programs to enhance the clustering. These included establishing of a specific maritime technology promotion program valued up to 100 million euro between 2014 to 2017.

The Government also started developing guidelines for Finland’s marine and maritime policy. The aim is to develop Finland’s marine and maritime policy into one of Finland’s key strengths. According to the Government, Finland must have high-quality marine competence, an innovative and constantly successful maritime cluster, and well-functioning, safe and environmentally responsible logistics.

The selected priority themes for the policy are marine protection, maritime logistics, maritime cluster and marine production. The pressures faced by the marine environment keep growing, including those associated with climate change and littering. At the same time maritime transport and the logistics sector as a whole will also be facing great changes. The financial ecosystem of the Finnish maritime cluster, composed of the various maritime industries and about 3,000 companies, is already a highly significant industrial sector, with total turnover as high as EUR 13 billion. Maintaining competitiveness and making use of opening markets are key factors for the growth of the maritime cluster.

AS one of the actions the Government also granted support to the maritime industrial associations’ project “Finnish Maritime Cluster” for enhancing further clustering from 2016 to 2020. See here. This book is one example of the results of this further clustering, achieved in the best cooperation of the various cluster branches.

The Finnish Maritime Cluster Study of 2015 itself was conducted by the University of Turku, Brahea Center jointly with the university’s Business School. The work on updating the cluster indicators for 2017 was carried out by the Turku University as part of the Maritime Information Portal project funded by the Finnish Government jointly with the European Maritime and Fisheries Fund (EMFF).

The aggregate net sales of cluster companies have increased annually since 2010 and growth is expected to continue for at least the next few years. However, the business outlook varies from one category to another due to cyclicality, which is a significant typical feature of the maritime industries.

Value chains and markets of the Finnish maritime cluster

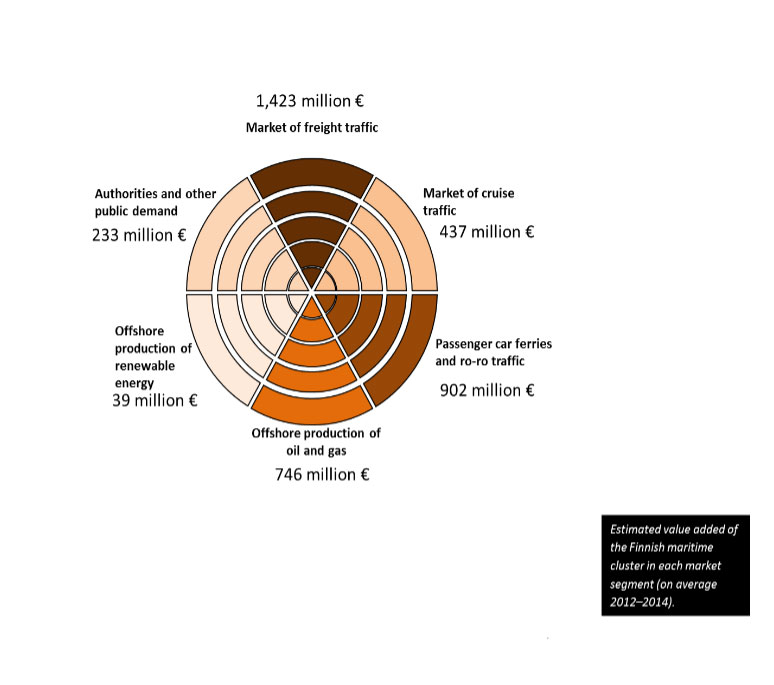

The Turku University Business School also developed a new way of structuring a maritime cluster, which method utilized value chain thinking from a global market perspective. When looking at the companies in the maritime cluster, six main market segments where identified for Finland while operating in international markets. These include freight, cruise, ferry and ro-ro, offshore oil and gas, offshore renewable energy production, and public demand. In other countries, market segments have different weights, but this division was found to emphasize the key business operations of Finnish operators. It is noteworthy that in each segment there are significant manufacturing and engineering activities of the marine industry for export markets, in addition to actual transport and operational activities. Shipping companies and ports, on the other hand, play a key role in Finland’s logistics systems as an enabler for foreign trade and, for example, as a guarantee of security of supply.

A total of EUR 3.8 billion was estimated for the value added of the entire maritime cluster of companies. On the basis of the evaluation, it can be stated that the different markets are in a satisfactory balance between each other. In the Finnish maritime cluster, no particular market segment plays a fully dominant role, but the activity is diverse. The maritime cluster is thus relatively strong in facing different cycles, as cycles often occur at different times in different segments.

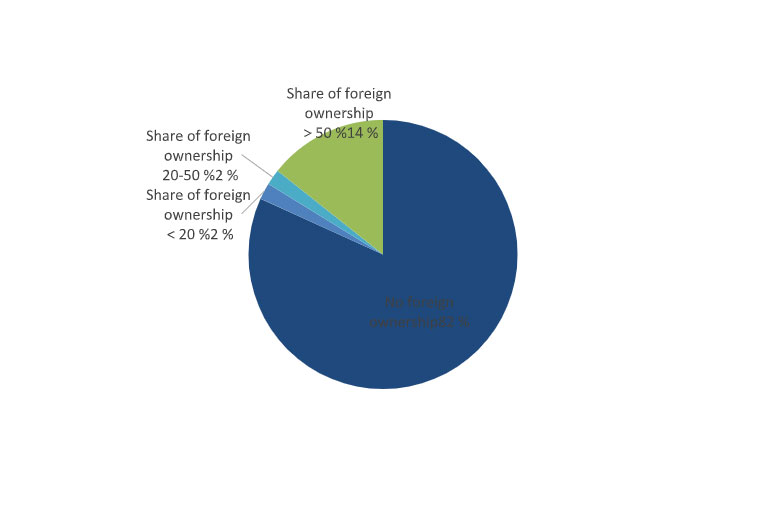

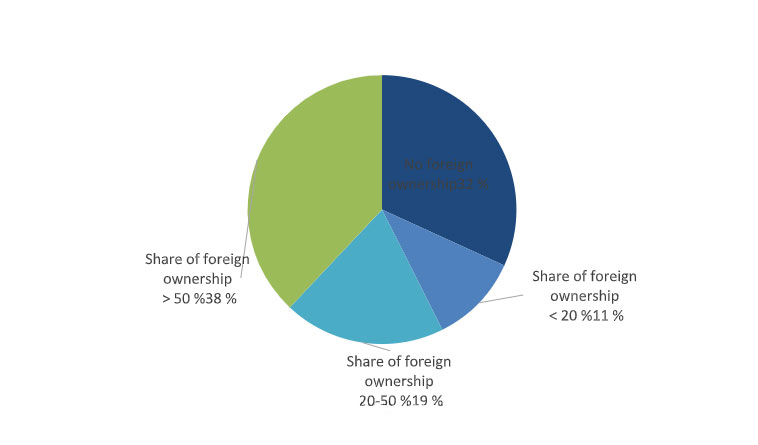

70 % of the cluster turnover is from foreign owned companies

Foreign ownership was one of the themes of the 2015 maritime cluster research study. Approximately 20% of the maritime cluster companies are at least partly foreign owned. Most of these (14% of all companies) were those with more than 50% foreign ownership. However, at least partly foreign-owned companies accounted for nearly 70% of the total cluster turnover in 2014 and over 60% of the total, indicating that large companies in particular are foreign-owned. In the interviews, foreign ownership was primarily seen as an opportunity, not a threat.

Importance of the innovation and innovation policy

Innovation appeared to be very important for almost all companies in the maritime cluster and innovation is diverse. Earlier studies showed the importance of the outsourced spin-off companies in the shipbuilding industry for growth. Now, large international networks are even more important for the cluster innovation than the domestic cluster, but nevertheless most companies still keep key R & D activities and strategic decision-making in Finland. In order to continue to retain a significant role in the future in the high value-added activities of the Finnish cluster, such as creation of innovations, a holistic view of the nature of the maritime cluster should be adopted in support of these activities. Cooperation with technologies represented by non-cluster actors is also of particularly high relevance today.

Promising visions for the future

According to the CEO interviews the short-term outlook varies in the maritime cluster, both for different main segments and for individual companies. The long-term future of the maritime cluster seems, however, to be quite bright at the moment and includes many opportunities for positive development for both large and small operators. However, the cluster is heterogeneous and future expectations therefore vary. The main business challenges in the research were the unstable state of the economy both on a national level and globally. Securing a skilled workforce is one of the key challenges of the future.

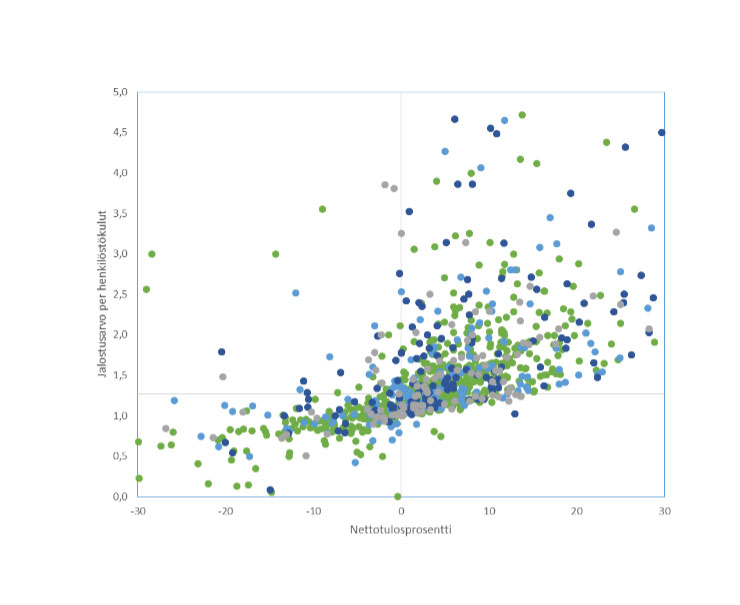

The profitability and productivity of companies in the maritime cluster are outlined in the so-called four-field model. The horizontal axis divides the companies into two groups based on the median of personal productivity (value added/personnel costs) and, respectively, the vertical axis according to the companies’ net profit percentage into two groups. The lower left quarter of the four-field is made up of companies with poor profitability and productivity. In 2014, one in four (25%) of the companies in the maritime cluster came to this quarter. The productivity of the companies on the right upper quarters is better than average and their cost structure enables efficient and profitable business. In 2014, about half (47%) of companies in the maritime cluster were in this business class.

The long-term future of the Finnish maritime cluster is driven by the use of different energy sources, sustainable operations development, global competition, changes in raw material transportation routes, use of marine resources, international regulation and digitalization, as well as automation. Future opportunities include specialty areas such as arctic expertise, battery technology or hybrid energy solutions, and high value-added products such as marine bio-economy, industrial symbiosis, or innovative packaging of production service chains. Threats include scarce resources for development and research, a decline in know-how, political and economic instability and the closed introvert work culture.

CONCLUSIONS:

• The Finnish maritime cluster is made up of companies that combine marine expertise and mutual interaction. The cluster’s versatility is not easy to see, for example, in media reporting on the industries.

• The marine cluster should be considered as a versatile market-specific value network. The versatility of the cluster’s demand structure means that the economic success of the cluster is not

homogeneous, but the fluctuations of the global market cycles affect the cluster parts in different ways and at different times.

• The activities of cluster companies are strongly international, and fostering international connections is the lifeblood of the cluster.

• The share and importance of foreign ownership in Finnish sea cluster companies has increased. Although foreign ownership is estimated to be largely positive in terms of the development of the industry, retaining of a fleet of Finnish ownerships and flying of Finnish flag must be ensured to maintain security of supply. It is therefore important to preserve the overall competitive national conditions now available in shipping.

• The influence of the 2008 financial crisis on the Finnish maritime cluster was dramatic. However, the aggregate turnover of the cluster companies have been steadily increasing since 2010 and growth is expected to continue for at least the next few years. The business outlook varies by main categories due to cyclicality, which is a significant feature of the industry. Especially in the construction of cruise ships, the outlook for 2020 and beyond is bright, while the oil and gas and global freight markets are currently facing challenges.

• The strength of the Finnish maritime cluster can be seen in the diverse markets that balance each other. There are already good examples of new emerging businesses in the blue bioeconomy and renewable energy developments

• Renewal of companies takes place through a wide range of innovation activities. We must therefore ensure that Finland has an operating environment that enables the launching and piloting of new ideas, technologies and operating models in Finland.

• New enterprises in the maritime cluster often arise to benefit from existing technologies or ideas that are still unknown from other fields. At present, companies involved in large-scale digitization processes, for example, combine technologies developed in other sectors with traditional maritime cluster activities, possibly revolutionizing industry practices.

• Shipping is an industry that operates strategically independently, building a growth-generating business. So shipping is not just a continuation of the transport network serving the needs of industry, but an independent industry that has to have its own business policy.

The competition between ports is intensifying as total traffic does not increase and logistically it would be cost-efficient to combine and concentrate export and import of general cargo. The Finnish transport system needs an overall visionary reform.

• The global field of action is unpredictable, so marine clusters must ensure their ability to survive by preparing for many future options. A strong knowledge base must be guaranteed by quality education and research. In particular, new maritime education and maritime training resources should be created.

• For many, the long-term future of the marine cluster seems to be quite bright and includes many opportunities for development for both large and small operators.

• In order to support international operations, not only cluster actors, but also administration, politicians and, for example, delegations from the public and private sectors, should strive to strengthen the brand of a high-quality and diverse Finnish maritime cluster.

Mikko Niini

Chairman, Finnish Maritime Association